Is A Roth IRA The Right Retirement Account For You?

Out of the plethora of retirement planning options available to U.S. workers — 401(k)s, 403(b)s, traditional IRAs — the Roth IRA stands out as the least restrictive plan, offering greater flexibility in the future in exchange for an up-front sacrifice in the form of taxes.

We’re taking a deeper dive into the pros and cons of the Roth IRA to mark National Estate Planning Awareness Week, occurring annually in October. Is the Roth IRA right for you and your retirement goals? Read on to find out.

A Bit Of Background

For those of you who might not know it, the Roth IRA is a fairly recent invention. It was created in 1997 as part of the Taxpayer Relief Act and is named for its legislative sponsor, Sen. William Roth of Delaware. The Roth IRA is often overshadowed by widely popular retirement planning options that are sponsored by employers, such as the 401(k), but it can be a great option for workers just starting to build their nest eggs.

How It’s Different

Unlike a traditional IRA, the income a worker places into a Roth IRA is taxed upfront rather than when money is withdrawn. That makes it ideal for upwardly mobile workers who plan on being in a higher tax bracket when they retire. For example, a Roth IRA makes more sense for a younger farmer who plans on taking over the family ranch in 25 years rather than a 55-year-old farmer who has already built a successful operation. The tradeoff is that you do not get a tax deduction for the contributions to a Roth IRA like you would for contributions to a traditional IRA.

Who Qualifies For A Roth IRA?

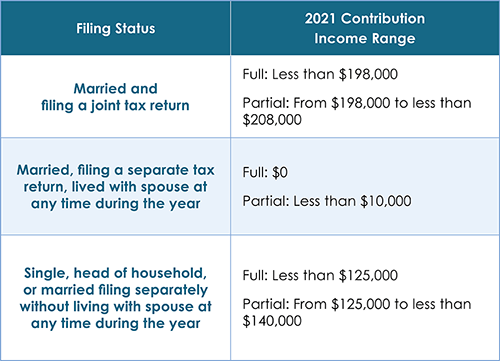

Contributions to a Roth IRA must be made from earned income, such as from a job or self-employment, rather than investment income. This type of account is unique in that contribution amounts are based on gross adjusted annual income. Contributions start to phase out once the investor begins earning $124,000 in gross adjusted income, with a full cap on contributions taking effect at $140,000. That makes the Roth IRA perfect for those in lower to middle-income brackets.

This chart shows the contribution income ranges for 2021.

Flexible Timing And Withdrawals

Roth IRA account holders enjoy more flexibility once they’re ready to start withdrawing because they’ve already paid taxes on the income in their accounts. Investors can begin taking cash from a Roth IRA at 59.5 years old — but once they do, there is no limit to how much they can withdraw at any given time, unlike other retirement accounts. The investor can also continue to contribute to a Roth IRA past the age of 70.5.

These benefits offer tremendous flexibility, but there are a few caveats. There is generally a 10 percent penalty for withdrawing before the maturity age of 59.5, and investors must have held the account for at least five years before taking payments from it. There are a few withdrawal exceptions to this rule, including:

- To pay for unreimbursed medical expenses

- To pay for health insurance premiums while unemployed

- In cases of permanent disability

- To pay for higher education expenses

- To pay for a levy imposed by the IRS

- If the investor is called away to active duty

- To buy, build, or rebuild a home

- If the IRA is received as part of an inheritance

- As part of a series of substantially equal periodic payments

Other Considerations

The annual contribution amount to IRAs is $6,000 annually, or $7,000 if the investor is over 50. However, that applies to all IRAs held by a single person; For example, someone who holds both a traditional and a Roth IRA cannot contribute $6,000 per account, but $6,000 in total. That $6,000 holds whether the investor is making $45,000 per year or $125,000 per year. Contrast that amount with a 401(k), which allows a contribution of up to $19,500.

A Roth IRA might be a good option for people who have a spouse who does not receive an earned income. A non-working spouse can contribute to a Roth IRA if filing jointly, which could ease the overall burden on the working spouse.

Discuss Options Before Investing

As with any investment decision, consult your CPA and your investment advisor about your retirement options. A Roth IRA is just one of the many ways you can save for your future, and your CPA/advisor will be able to walk you through several factors, such as your current income tax situation, future tax implications, when to withdraw from the account, and how much to contribute annually.

If you decide to open a Roth IRA, you should do so with a qualified investment advisor to best invest your contributions. Whatever route you choose, it’s crucial to keep in mind the importance of saving for retirement. Most Americans have woefully underfunded retirement accounts, with up to one in four reporting no savings at all. Check out this previous article on how to shape your retirement plan and determine what you’ll need. Call us at 209-527-4220 or email us at contactus@gccpas.net. As always, you can count on us to answer your questions, big or small, so that you can live your golden years as comfortably and prosperously as possible.