A Tax-Savvy Way to Give: Making the Most of Charitable Trusts

Charitable trusts can be a powerful way to make a meaningful difference to support causes you care about, while also enjoying substantial tax benefits. By strategically donating funds into a charitable trust, you can receive an immediate tax deduction, create a predictable income stream, and potentially reduce the size of your taxable estate. It’s a win-win-win: you give back to your community and get an immediate tax deduction while fine-tuning your long-term financial plan.

Whether you choose a charitable remainder trust or a charitable lead trust, these strategies can help you align your philanthropic goals with your financial and estate planning strategies. Let’s explore which type might fit your needs.

What is a Charitable Trust?

A charitable trust is a legal arrangement that allows you to support nonprofit organizations you care about by donating assets while also providing financial benefits to you or your estate. Basically, you turn your assets—like cash, stocks, or real estate—into a legacy that keeps giving into the future.

Charitable trusts are typically irrevocable, meaning that once you set one up and transfer assets into it, you generally can’t change your mind. That might sound restrictive, but that permanence is part of what gives these trusts their tax and estate planning advantages. In certain cases, modifying or terminating the trust is possible through a court order or agreement among beneficiaries.

In general, charitable trusts fall into two main types:

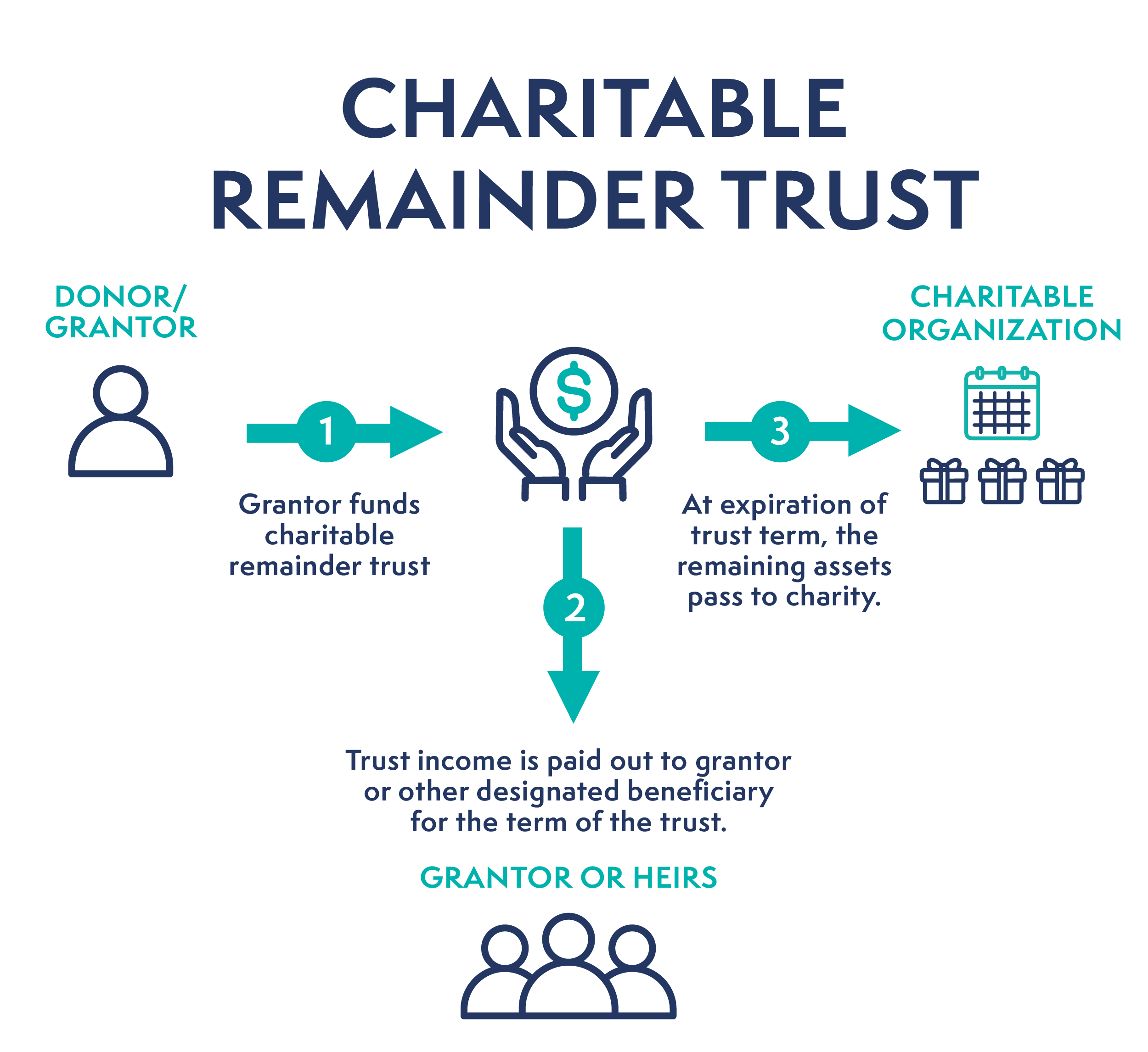

Charitable Remainder Trust (CRT) – With a CRT, the donor transfers assets into the trust, receiving a fixed dollar amount each year from the trust during the donor’s lifetime (or a set amount of time called a trust term). When the trust term ends, the remaining assets go to your chosen charity.

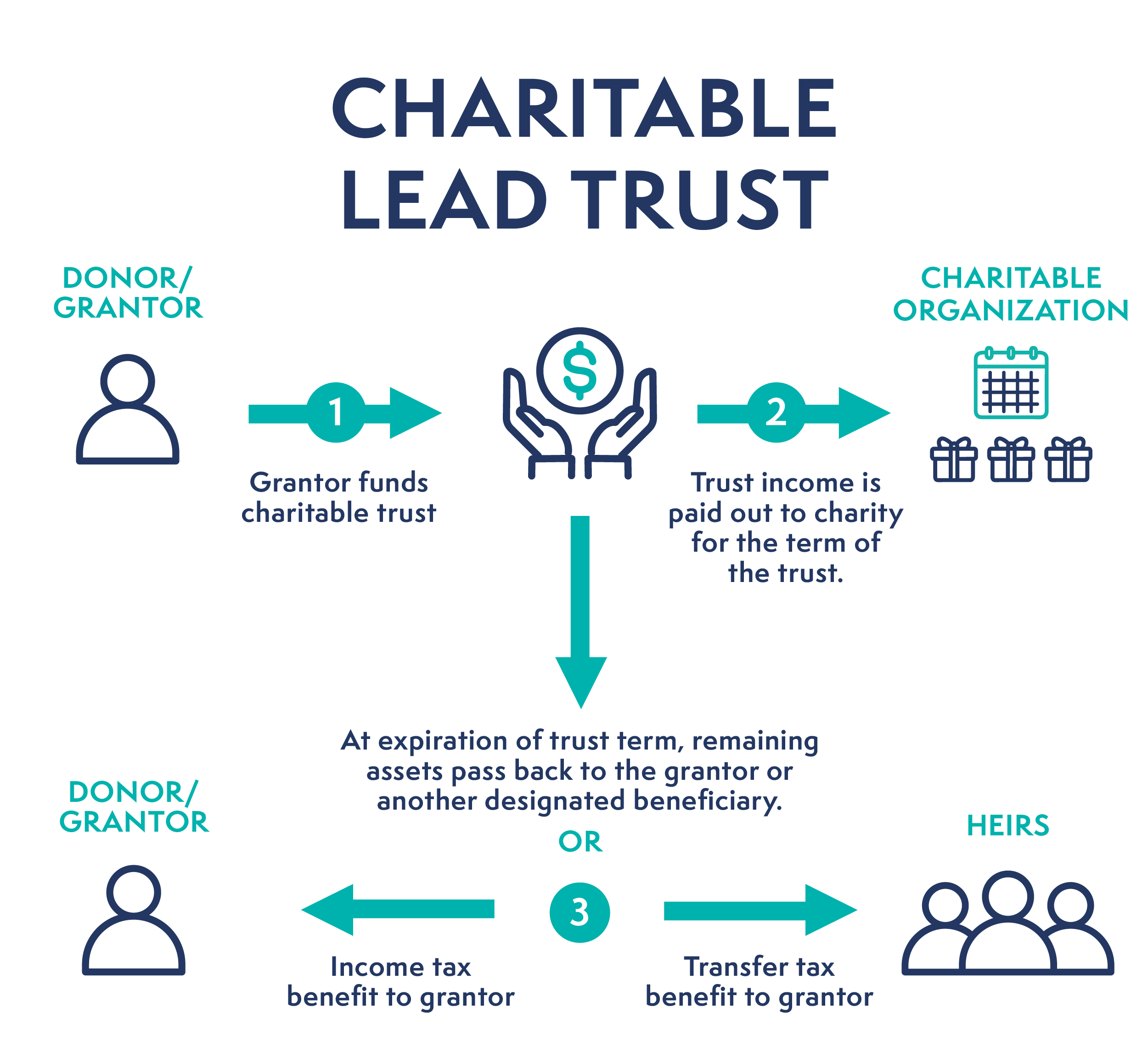

Charitable Lead Trust (CLT) – With a CLT, the charity receives income first for the duration of the trust term. When the trust term ends, whatever remains goes back to you or your heirs.

Both types of trust can be used for tax and estate planning. They require legal setup, annual tax filings, and careful planning with an attorney and tax or financial advisor.

A CRT can be beneficial if you hold current appreciated assets like stock or real estate. CRTs remove the assets from your estate right away, whereas the CLT can bring assets back into your estate at the end of the trust term.

What Are the Benefits of Setting Up a CRT or CLT?

Charitable trusts are especially appealing when you want to:

How Do CRTs and CLTs Offset Income Tax?

When you fund a charitable trust, you can claim a charitable deduction for the present value of the amount that will eventually go to the charity. This deduction can offset a portion of your taxable income—potentially lowering your tax bracket in a high-income year.

Example: Let’s say you receive $2 million from selling a business. Placing part of it in a CRT could:

- Provide you with an immediate charitable deduction, reducing your income now.

- Although taxable, CRTs and CLTs create a steady income stream for you over time.

- Leave a lasting legacy for a cause you care about while reducing your overall tax burden.

Which Trust Type is Right for You?

Are There Downsides?

- For CRTs, payments you receive are taxable income.

- For CLTs, assets return to your estate at the end, which may affect estate taxes if your estate exceeds the exemption threshold.

- For both, you’ll need to fund the trusts at a high enough level to have the tax savings outweigh the annual management and tax filing costs.

What About the Current Estate Tax Exemption?

The current federal estate tax exemption is historically high (over $12 million). While fewer estates are subject to estate tax, everyone pays income tax, making charitable trusts especially attractive as an income tax planning tool rather than purely an estate tax strategy. Still, high-net-worth individuals and families should review their total estate value to see if estate taxes are a concern.

What Steps Should I Take to Set Up a CRT or CLT?

Setting up a charitable trust involves legal, tax, and financial considerations. Your planning team should include an estate attorney to draft the trust documents, a financial advisor to manage investments and distributions, and a CPA to ensure the strategy aligns with your tax goals and to manage the yearly tax filings.

Charitable trusts are just one tool in the wealth planning toolbox, but for the charitable-minded, they can be a powerful way to maximize social impact while minimizing taxes.

Get in Touch

To learn more, contact us to schedule an appointment. We’re happy to explore charitable trust options to help you reach your financial, tax, and charitable goals.