Businesses: Navigate Tax and Compliance Across State Lines Without Crossing Legal Lines

In today’s interconnected world, expanding your business across state lines is no longer a luxury; it’s the new frontier of growth. Expanding across states can open doors to new markets and untapped opportunities, but it also presents one undeniable challenge: navigating the complex maze of multi-state tax compliance.

Whether you’re hiring remote employees, selling online, or storing inventory out of state, there’s one key concept to keep in mind: state tax nexus. State tax nexus is the connection between your business and a state that can trigger tax obligations. Understanding nexus and its implications can be the difference between smooth growth and unexpected liabilities. Let’s break it down.

What is Nexus, and How Do You Know if You Have It?

Prior to 2018, businesses needed a physical presence, like an office or warehouse, to establish tax responsibilities in another state. But in 2018, everything changed with the Supreme Court case South Dakota v. Wayfair. Now, states can require businesses to collect sales tax based on economic or digital presence, even if no physical footprint exists.

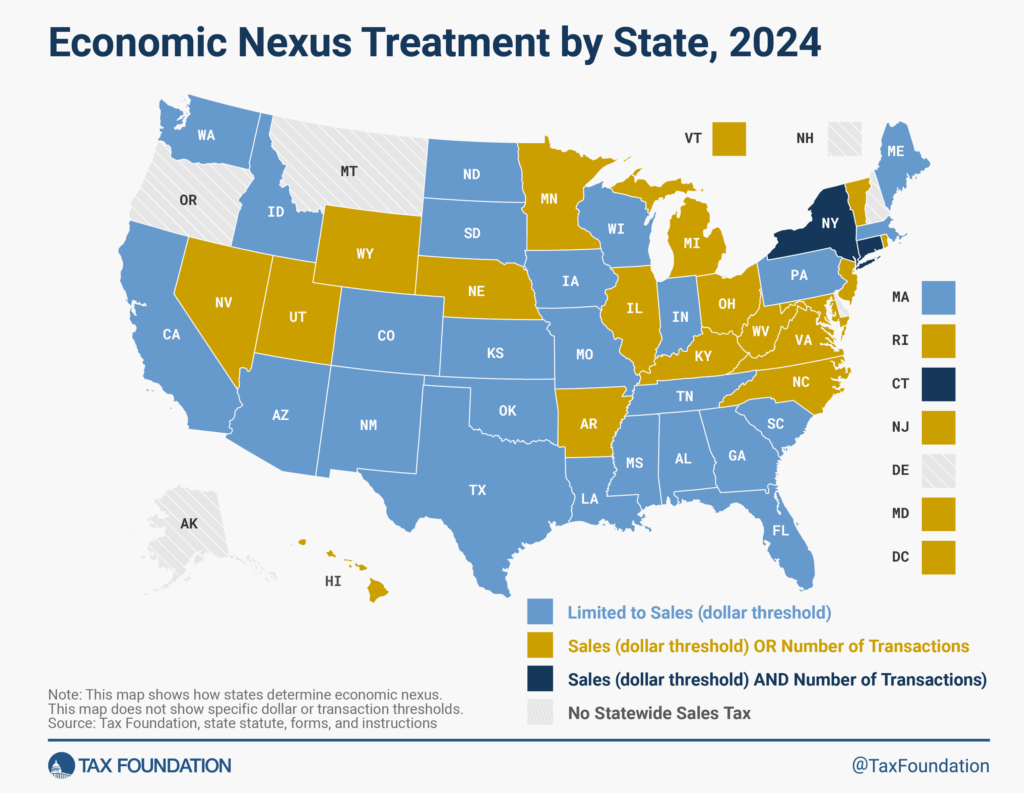

Here’s where it gets tricky: nexus rules vary by state. Some states enforce economic nexus laws based on specific sales thresholds, as low as $100,000 in sales or 200 transactions annually. So, if you’re growing your e-commerce or remote operations, focus on where your business activities might trigger these obligations.

Physical Nexus vs. Economic Nexus: What’s the Difference?

To navigate compliance, it’s crucial to understand the two types of nexus:

- Physical Nexus: Triggered when your business has a physical presence in a state, such as an office, warehouse, or employees.

- Economic Nexus: Triggered when you sell a certain volume of goods or services in a state, even without a physical location.

- Affiliate Nexus: Sales tax obligations can arise if your business has a relationship with an in-state affiliate or subsidiary, such as shared ownership, branding, or other connections.

- Click-Through Nexus: States may require sales tax collection if your business pays commissions or referral fees to third-party sellers or marketers for sales generated through their platforms or efforts.

Top Triggers That Establish Nexus

Below are the four main factors that commonly establish nexus:

- Sales Volume in a State: Many states require sales tax collection once you exceed specific thresholds. Most states set these at $100,000 in sales or 200 transactions a year—but always double-check, as thresholds vary.

- Physical Presence: Any tangible presence, such as an office, storefront, or even a single sales rep, could establish physical nexus.

- Inventory Stored in a State: Using third-party logistics providers like Amazon’s fulfillment centers? Storing goods in a state—even temporarily—can potentially create nexus and tax obligations.

- Employees in a State: Remote employees engaged in activities like sales or inventory management can trigger nexus. Even one employee in another state could be enough, depending on their role.

What Taxes Might You Owe?

If your business crosses state lines, here are the taxes you’re most likely to encounter:

- Income Tax: A nexus with a state typically means filing a corporate income tax return, potentially even if your business isn’t profitable in that state.

- Sales Tax: Once you meet a state’s economic nexus threshold, you’re required to collect and remit sales tax.

Take a look at this chart, which outlines how states determine nexus.

Some states, like Delaware, don’t impose sales tax but may have alternative taxes such as gross receipts taxes. Knowing the specifics of each jurisdiction is essential. For a state-by-state summary, visit the Sales Tax Institute for a helpful table outlining the key tenets of economic nexus rules.

Common Misconceptions to Avoid

Some nexus assumptions can land you in hot water. Here are two to be aware of:

How to Stay Ahead with Tax Planning

State tax nexus compliance doesn’t have to be overwhelming. With proactive planning, your business can confidently tackle multi-state tax obligations. Here’s how:

- Track Everything: Keep detailed documentation of sales, invoices, and taxes collected.

- Plan Ahead: Before expanding to a new state or hiring remote staff, assess potential tax liabilities.

- Monitor Thresholds: Regularly review where your sales or operations might exceed nexus thresholds.

- Register for Permits: Apply for sales tax permits in states where you have obligations.

- Automate Compliance: Tools like tax compliance software can simplify multi-state filings.

- Consult your Advisor or an Expert: Don’t guess—work with a tax advisor to ensure you’re on the right track.

The Cost of Non-Compliance

Failing to meet your state tax obligations isn’t just risky—it’s expensive. Here’s what’s at stake:

- Fines and Penalties: States can impose harsh penalties for late or uncollected sales taxes.

- Back Taxes: Neglecting nexus rules can lead to years of accumulated liabilities.

- Hindered Business Sales: Non-compliance creates complications with potential buyers.

Grimbleby Coleman Can Help

Navigating tax laws doesn’t have to be daunting. At Grimbleby Coleman, our tax experts specialize in helping businesses handle multi-state tax responsibilities with ease. We’ll help you assess your risk, develop a compliance strategy, and stay ahead of changing regulations.

Don’t let tax challenges hold you back. Contact Grimbleby Coleman today to help your business stay compliant.