How Much is Enough? Break-even and Profit Analysis

By Martin Fox, CPA/ABV, CVA

Do you know what your break-even point is? Your break-even point represents the number of units you need to sell to exactly cover your costs with no profit or loss. Break-even analysis is the calculation needed to answer this and other questions, such as:

-

How much do I need to sell to generate my desired profit?

-

How does my profit change if my margins go up or down?

-

What if I need to add more overhead? How many additional units will I need to sell?

“For ag entities, it is critical to understand your break-even point to ensure you are making a profit on your crop,” says Marty Fox, CPA and Principal. “These calculations can be helpful if you need to add additional help or if you incur a new expense because you’ll be able to calculate how that is going to affect your bottom line.”

To start, you’ll need to know four things:

- The price you charge for the products and/or services you sell.

- The quantity (or volume) of products and/or services you sell.

- The costs you incur directly in producing or buying the products and services you sell. We call these variable costs because they increase or decrease as your sales increase or decrease.

- The costs you incur whether you make any sales or not. These are best described as fixed costs because they do not change with fluctuations in sales volume — at least, not on a day-to-day basis.

You’ll also need to know your current or expected gross margin. Simply put, your gross margin is the difference between your sales price and your direct (variable) costs divided by your sales price.

Calculating Your Break-Even Point

- You buy your products for $60 apiece.

- Each product sells for a price of $100.

- Your gross margin is the $40 markup divided by the $100 sale price, or 40%.

The basic formula for your break-even point is:

![]()

Or, using the above example, assume your fixed costs (administrative, leases, wages, etc.) are $100,000. The break-even point is calculated as follows:

![]()

You will need to sell 2,500 widgets in order to break even.

But we know that breaking even is not your goal. You need to make a profit to pay off your loans, reinvest in new equipment, and give yourself a return on your investment and hard work.

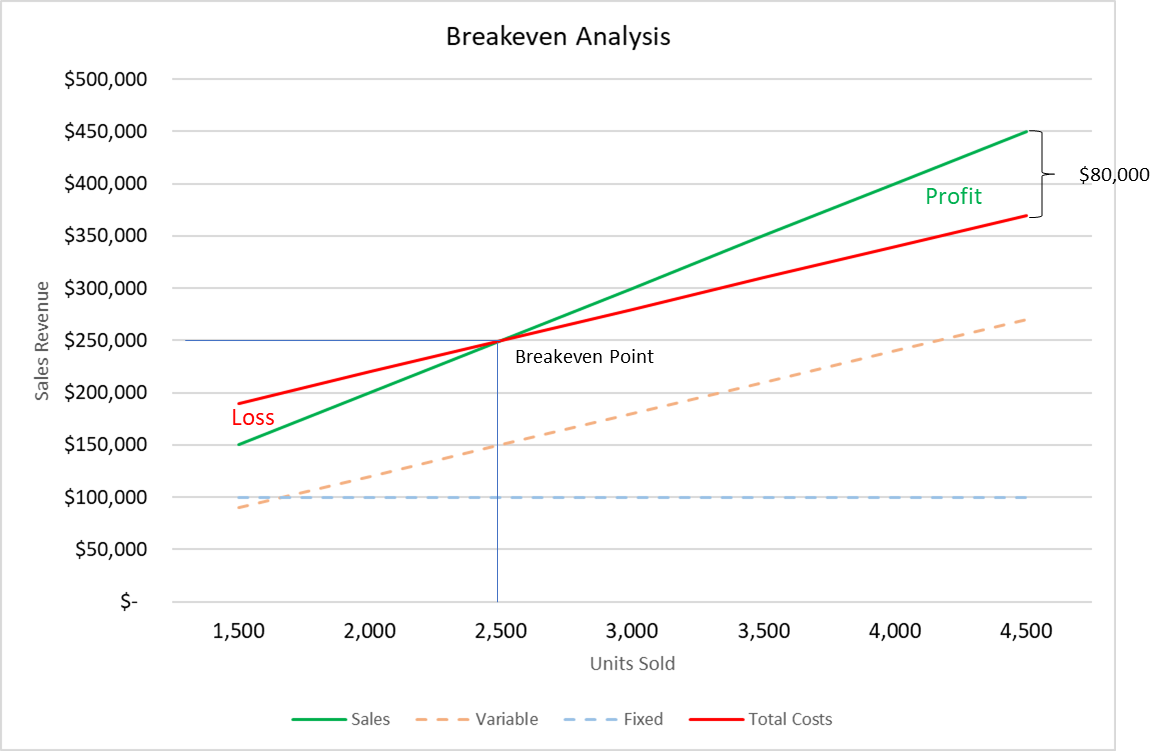

With a slight variation, you can calculate how many units you’ll need to sell to achieve a given profit. Let’s say you want to generate $80,000 in profit from your business. The modified formula is:

Or, in our example…

![]()

We can display this information in the following graph:

As you can see, every unit sale above your break-even point of 2,500 increases your profit. In this case, you need to sell 2,000 units more than your break-even point in order to generate a profit of $80,000. Conversely, if unit sales fall below 2,500 units, you will lose money.

This calculation is only good to a certain point. For example, as your sales increase, you may need to add additional overhead costs. The $100,000 in fixed costs you used initially may go up to $130,000 once sales hit 4,000 units. By changing the numbers in your formula, you can easily calculate your new break-even point.

Planning for Success

Before you start on a new venture or strategic change, you need to know if your plans will meet your financial needs. If not, you’ll need to adjust your selling price, costs, or expenses. By using this analysis and other tools we have available, you’ll be able to see how changes in volume, price, margins, and expenses can impact your bottom line.

You can count on us to give you deeper insights into your business so you can make better decisions. For more information or to discuss conducting your own break-even analysis, please contact your Grimbleby Coleman advisor or reach out to our team to get started.