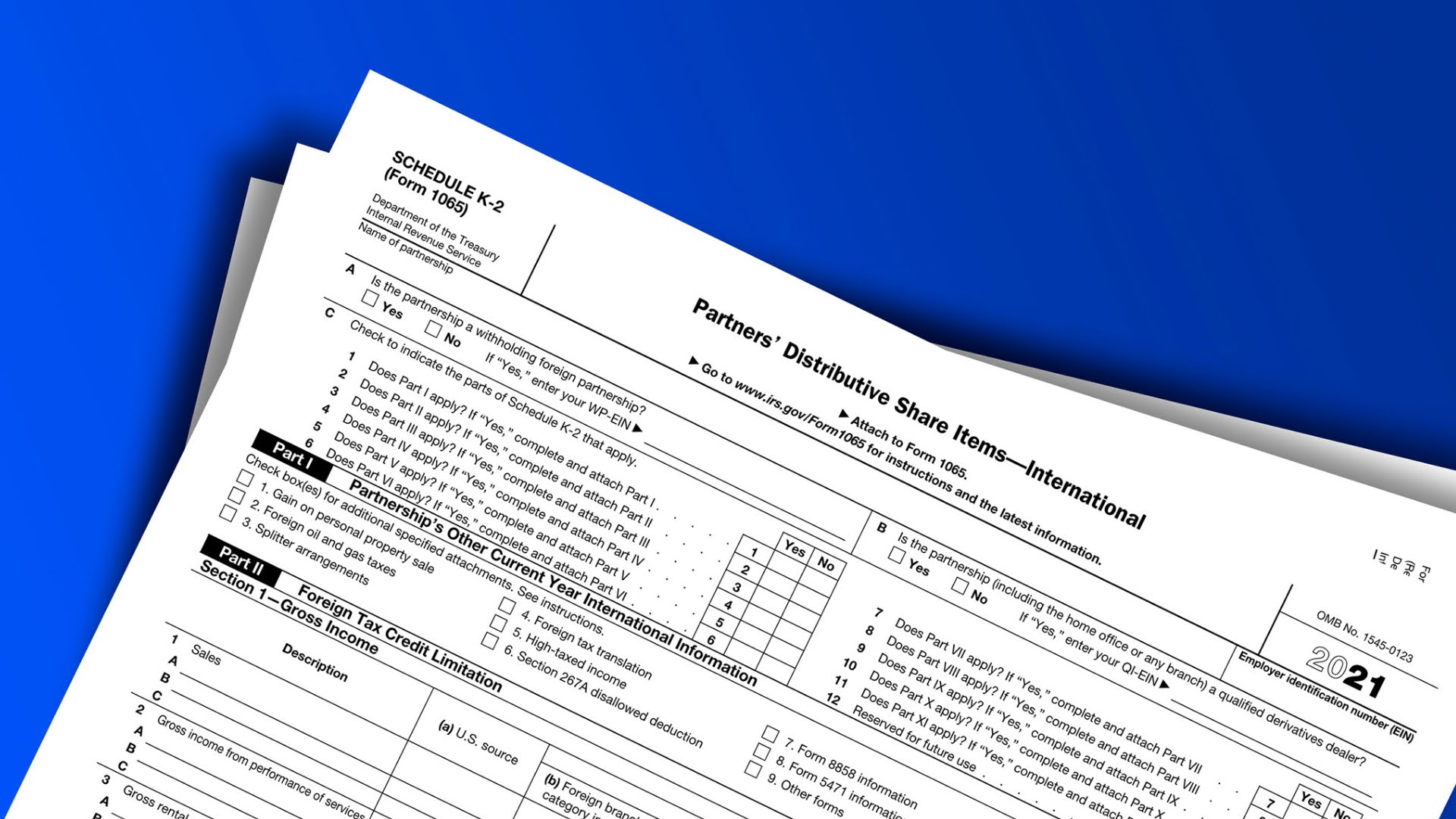

IRS Schedule K-2 and K-3 Reporting Instructions and Requirements

Last year we notified you of some new tax return forms affecting partnerships, LLCs, and S Corporations — the K-2 and K-3 Estate and Trusts. Though, in many cases, unless you had significant foreign activity, these forms did not apply but were still required to be filed with your return, adding unnecessary complexity, cost, and carrying a steep penalty if they were not filed.

The IRS has provided welcome relief for 2022 by providing an exception to the requirement to file these forms, which will apply to most domestic Pass-Through Entities (PTE). The exception states that these schedules are not required to be completed for a PTE under the following conditions:

- The entity has no or limited foreign activity, which is specifically defined in the instructions and includes domestic entities whose only foreign activity is passive category foreign income that:

- Only generates $300 or less of taxes subject to the Foreign Tax Credit; and

- Is shown on a payee statement such as Form 1099-DIV;

- All partners/shareholders are U.S. citizens or resident aliens, domestic decedent estates, or certain domestic trusts;

- The entity sends a specific notification to the partners/shareholders two months before its filing deadline, without extensions (January 15th for calendar-year entities); and

- No partners/shareholders specifically request Schedule K-3 Estate and Trusts from the entity prior to one month before the entity’s filing deadline, without extensions (February 15th for calendar-year entities). If the information is requested after February 15th, then the entity only has to provide the information to the requesting partner/shareholder and does not have to file the K-2 and K-3 Estate and Trusts with the IRS.

Steps you will need to take now

- Notify your partners/shareholders by January 15th that your entity meets the exception and will not be filing the K-2 and K-3 Estate and Trusts forms.

- Wait to see if your partners/shareholders respond by February 15th that they need a Form K-3 Estate and Trusts.

- Notify your accountant of the results of steps 1 and 2 above.

Sample notification

GC has provided language in this document that you can use to email or mail out the notification to your partners/shareholders.

Get in touch

Contact your GC accountant or advisor to learn more or if you need assistance determining whether you should file these schedules. You can reach our team at contactus@gccpas.net or (209) 527-4220.