Maximize Your Estate Plan: Capitalize on Estate Tax Exemptions Before 2026 Changes

Significant changes in estate tax laws are on the horizon, and preparing now can save you substantial sums in the future. With the current estate tax exemption set to decrease on January 1, 2026, taking advantage of the existing exemptions today is more important than ever.

Why Estate Planning Needs to Happen Now

The Tax Cuts and Jobs Act (TCJA) brought substantial benefits to high-income earners, including a temporary increase in the estate tax exemption to $13.61 million per individual or $25.84 million per married couple in 2024. However, these provisions are sunsetting at the end of 2025, meaning the exemption will revert to approximately $6 million per individual. This change could lead to substantial estate tax liabilities for those with significant assets.

Understanding the TCJA and Its Impact

The TCJA provisions increased the estate tax exemption but only temporarily. As the law sunsets, many changes will come into effect in 2026, including a significant reduction in the exemption. It’s crucial to start thinking about your estate plan now to optimize your tax benefits.

Who Should Be Concerned?

If your total assets exceed $6 million, it’s time to act. Whether your wealth is in real estate, stocks, or a family-owned business, the impending changes will affect you. For instance, if you’re a farmer with $10 million in land, you might want to ensure it remains within the family. Alternatively, if you have a large stock portfolio, now is the time to consider gifting to the next generation.

The Importance of Proactivity

Proactive estate planning involves more than just making a will and having a living trust. If you plan to gift real estate or business interests, these assets must be appraised, and appraisers can be booked months in advance. In 2012, we saw a similar rush, with appraisers overwhelmed and unable to meet the demand. Don’t wait until 2025 to start the appraisal process—specialty properties, especially, require ample time for valuation.

How Can Accountants Help Optimize Your Estate Plan?

Our role as business advisors goes beyond crunching numbers. We collaborate closely with attorneys to review your estate plan and suggest necessary changes. For instance, if you’re interested in charitable giving, we can help you leverage charitable trusts to maximize deductions. This approach not only fulfills philanthropic goals but also provides significant tax advantages.

Key Strategies to Consider

- Spousal Lifetime Access Trust (SLAT): This irrevocable trust allows one spouse to make a gift into a trust for the other spouse’s benefit, removing assets from the estate while still providing access to them.

- Irrevocable Trusts for Descendants: These trusts ensure that assets are transferring to your children or other descendants, securing their future, and minimizing estate taxes.

- Charitable Trusts: If you’re charitably inclined, these trusts offer a way to make substantial donations while benefiting from tax deductions.

For additional information on estate and gift tax exemptions, click here to read this helpful article from Kiplinger.

Immediate Next Steps

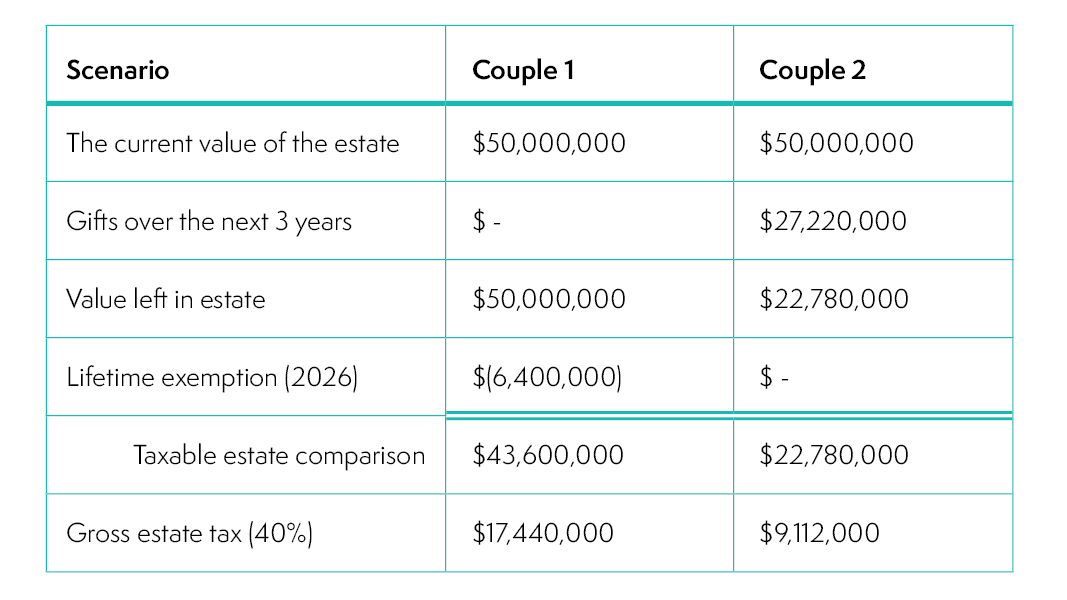

Currently, you can gift up to $13.61 million per individual with no gift or estate tax consequences. If you act now, you can significantly reduce your taxable estate. Consider this scenario:

The takeaway: The couple who failed to utilize the expanded exclusion amount before it expires will pay an additional $8.33 million in estate taxes.

Looking Ahead

Don’t wait until the last minute to secure your estate. The upcoming changes in estate tax laws necessitate immediate action to optimize your financial legacy. At Grimbleby Coleman Advisors and Accountants, we help you navigate these complexities, ensuring your assets are protected, and your estate plan is optimized. Contact us today to start planning your future.