What You Need to Know About the Payroll Tax Deferment

By Will Morgan

September 11, 2020

On September 8, 2020, an executive order was signed by President Trump to defer the withholding, deposit, and payment of certain payroll tax obligations as relief in response to the coronavirus (COVID-19) pandemic. We’ve carefully outlined a summary of the order to help answer any questions that may arise.

Notice 2020-65 allows, but does not require, employers to defer the withholding and payment of the employee share of social security tax ordinarily due during the period from September 1, 2020, through December 31, 2020, for employees with earnings below a threshold amount ($4,000/bi-weekly). The IRS notice indicates employers that defer the withholding and payment of taxes in 2020 must withhold and pay the deferred taxes ratably over the period from January 1, 2021, through April 30, 2021.

Although the Notice does not specifically say whether the payroll tax deferral is mandatory, the deferral seems to be voluntary.

According to the notice, employers who wish to use the deadline extension would need to “double-up” on withholding the employee’s share of Social Security (i.e., withhold 12.4% from January 1 to April 30, 2021, instead of the normal 6.2% of wages up to the OASDI annual wage base). This is assuming the employee is still working for the employer and that the employee has sufficient wages to withhold from. If there is a separation of employment, the employer would be “on the hook” for repaying the tax in early 2021. The Notice clearly places responsibility on employers for withholding and depositing the deferred taxes and that penalties generally would apply for any failure to do so (although the Notice says that employers can “make arrangements to otherwise collect the total Applicable Taxes from the employee”). At this point, it is not clear what “make arrangements” entails.

Effective Date and Wage Limits

- Plan to defer deposit, withholding, and payment of Social Security Tax (6.2%) on wages or compensation paid during the period of 9/1/2020 – 12/31/2020. It does not apply to the 1.45% employee’s share of Medicare taxes

- Affected Taxpayers has determined that employers that are required to withhold and pay the employee share of social security tax under section 3102(a) or the railroad retirement tax-equivalent under section 3202(a) are affected by the COVID-19 emergency for purposes of the relief described in the presidential memorandum and Notice 2020-65

- Available to any employee whose wages are less than $4,000/bi-weekly pay period, calculated on a pre-tax basis, or the equivalent amount with respect to other pay periods. Ex. ($2,000/weekly pay period). This also includes salaried workers earning less than $104,000.

- If wages are under the $4,000/bi-weekly pay period threshold, this is referred to as Applicable Wages. Applicable Wages are determined on a payroll period by payroll period basis.

- Applicable Wages means wages as defined in section 3121(a) or compensation as defined in section 3231(e) paid to an employee on a pay date during the period beginning on September 1, 2020, and ending on December 31, 2020

- Deferred without any penalties, interest, additional amount, or addition to the tax.

When will this be due?

- Affected Taxpayers of the withholding of payment of the tax is postponed until 1/1/2021 – 4/30/2021. During this time, employees will be faced with double withholdings of Social Security taxes.

- If tax is not paid by 4/30/2021, interest, penalties, and additions to tax will begin to accrue on May 1, 2021, with respect to any unpaid Applicable Taxes.

- If necessary, the Affected Taxpayer may make arrangements to otherwise collect the total Applicable Taxes from the employee. There are currently no details on that requirement.

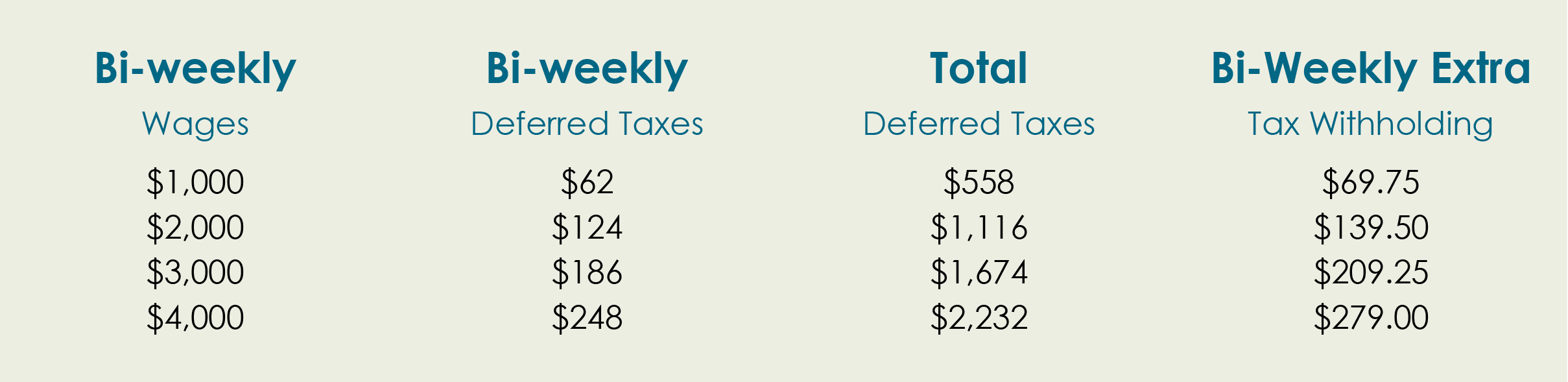

The chart below shows how the deferral and withholding works. For example, if an employee runs biweekly payroll with the first pay date after September 1 falling on September 7, the employer would defer the employee share of Social Security taxes over 9 pay periods in 2020 but would regain over 8 pay periods in 2021. An employer with $1,000 in wages per pay period would see an increase for $62 per pay period in take-home pay for the remainder of 2020. The employee’s take-home pay in 2021 would be reduced by $69.75 per pay period to recoup the deferred taxes.

Some Key Takeaways

It’s important to note the following on this temporary order:

- Neither the memorandum nor the Notice eliminates the tax liability. The payroll taxes are deferred, not forgiven.

- The deferral only applies to the Social Security tax portion (6.2%) of FICA.

- If there is a separation of employment, the employer would be “on the hook” for repaying the tax in early 2021.

- Employers can choose to opt-in; employees cannot choose to opt-in or out.

There are currently many unknowns related to this temporary order. We will continue to closely follow any developments on the Payroll Tax Deferment to help you understand your options and obligations. Please reach out with any questions to Will Morgan, wmorgan@gccpas.net or 209-527-4220.