Still Trying to Decide Whether to Begin Estate Planning?

October 17 – 23, 2022, is a favorite time of the year for our Estates and Trust team — it’s National Estate Planning Awareness Week. If you’re like many Americans, you may not think you need an estate plan or even know where to start. The number of people with estate plans rose during the COVID-19 pandemic. Even so, two out of three adults still don’t have a will. But whether you’re 18 or 80, there’s no time like the present to plan for the future.

At Grimbleby Coleman, we often deal with the fallout from lacking or inadequate estate planning. In a probate state like California, the consequences of not having a trust or will can be expensive, time-consuming, and more emotionally difficult for the family members who must take charge in the aftermath. Without an estate plan or will, a decedent’s assets will go public, and the courts will assume control and make decisions – including designating heirs, the main component of estate planning. Whether it may be a summer house or a stock portfolio being split, the process can take years, rack up fees, and get ugly. Court personnel do their best – but how can they know your wishes? The courts also don’t always rule for all assets to go to the surviving spouse.

With just a few hours of planning and a great team supporting you, you can leave a legacy and give you and your family the ultimate comfort: peace of mind. Unfortunately, over the years, we have heard misplaced phrases like these to justify not preparing an estate plan or will:

“I am too young to think about that.”

“All my property is titled in joint tenancy with my spouse, so I don’t need a will.”

“Estate planning is for the wealthy.”

“I don’t have the time or money for estate planning — it’s expensive.”

“Won’t the government take care of it if I don’t have one?”

“We did our wills after we got married many years ago, and we don’t think we need to do anything more right now.”

If any of these have popped into your head at some point, you are not alone. We assure you that everyone over the age of 18 should have an estate plan or at least a will, regardless of how small you believe your asset portfolio to be.

Resources to help you decide

If you are considering what to do, we encourage you to look at our library of estate planning articles for scenarios that can help you take your first steps.

- Case Study: Simplifying an Estate Plan for a Smoother Transition

- Is a Roth IRA the Right Retirement Account for You?

- Shaping Your Retirement Plan and Determining What You’ll Need

- Five Questions to Consider for Estate Planning

- Starting a Succession Plan is Scary — But Important

- Control, Privacy, and Peace of Mind-The importance of Estate and Trust Planning

- How is the Health of your Estate and Trust Planning?

- New Case Study: An Ag Family Succession Story

- Top 5 Keys to Succession Planning

- How to Let Your Money Live on With a Charitable Remainder Trust

- You’re Dead… Now What?

- Succession Planning for Farming Families: Scary, But Necessary

Our process

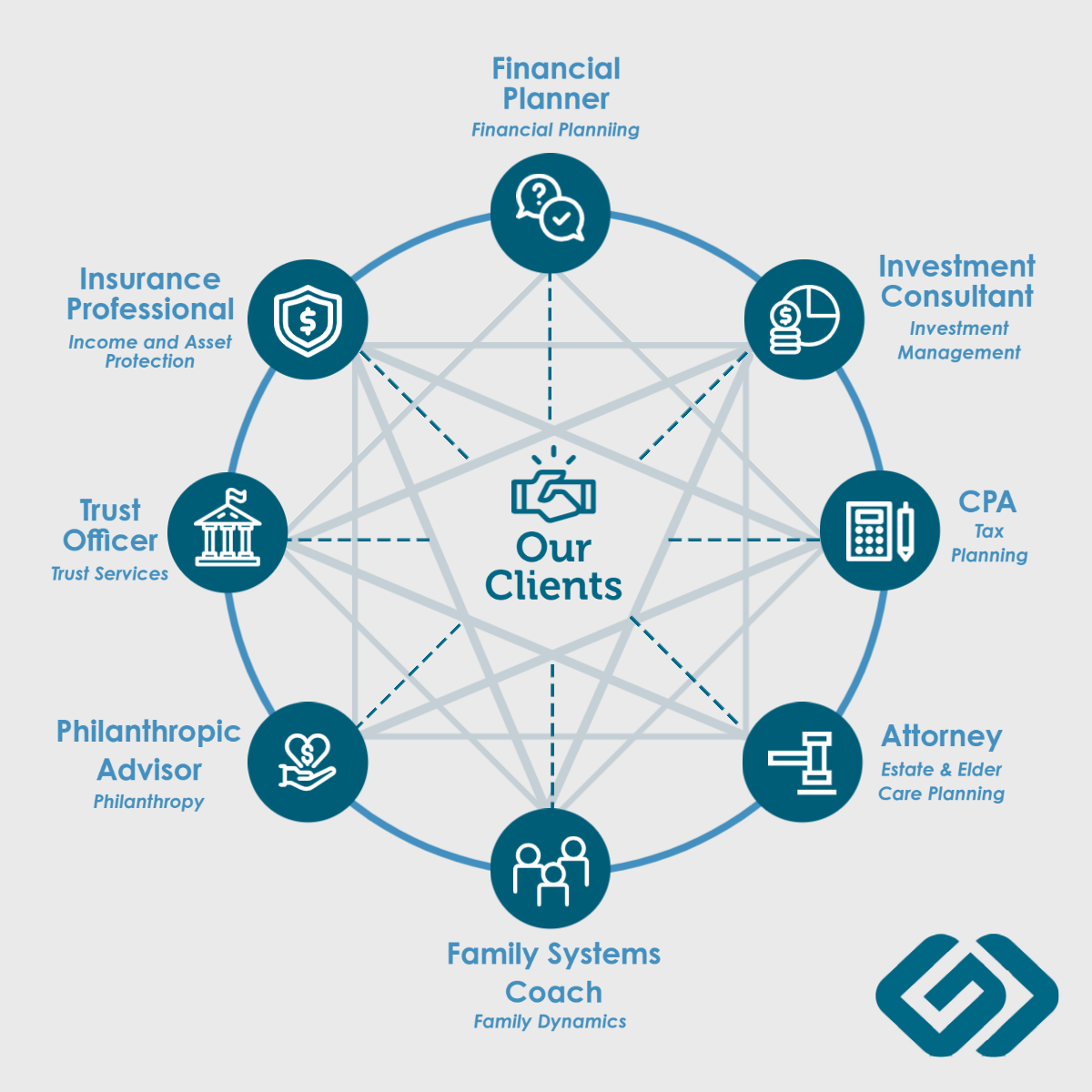

Estate planning with GC is a collaborative process with multiple steps, often involving other professionals. From attorneys to financial planners to insurance professionals, GC has the language and the skills to map a course to fit the simplest of estates all the way to a complex estate plan. It begins with the discovery phase, where you can share your goals and reveal your complete financial picture. We then start the research and plan creation phase, where our Estate and Trust team goes to work, in concert with other professionals, researching and designing the documents to best fit your wishes. Next is the execution phase, where the plan will be fully implemented. Finally, an ongoing review process is essential for any estate plan. Changes are a constant, and your plan should be reviewed regularly and amended as needed.

This image illustrates the various entities that can be involved in estate planning and how GC can bridge the gap to help bring it all together.

Get in touch

Autumn and winter are the perfect time to revise current estate plans or get started on new ones, especially after the wild financial ride we’ve known as 2022. GC has been helping business owners and individuals plan their estates for years. Feel free to contact us — whether you’re just getting started or revising a plan that has been in place for decades, we can help. Reach out to our team at contactus@gccpas.net, or call us at (209) 527-4220.