Insights

Get Insights and Sound Advice That Combine Technical Expertise With Industry Expertise

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

Human Resource (HR) Consulting Services are designed to help small and mid-sized businesses reduce risk, stay compliant, and create healthier workplaces. Compliance with California labor…

Tax time can be overwhelming, particularly with the various documents you need to gather. It is easy to lose track of what is essential. Whether…

GC is always working to keep you informed about new tax law updates, particularly when they affect everyone. All of us receiving a California paycheck are…

Grimbleby Coleman Advisors and Accountants is dedicated to delivering the highest level of service and personal attention, not only as it pertains to advisory, tax,…

Just in time for the new year — another filing requirement for business owners. Starting January 1, 2024, business owners will be responsible for reporting…

The Tax team here at Grimbleby Coleman has been keeping an eye on news about the Federal and State Tax deadlines. In a previous update,…

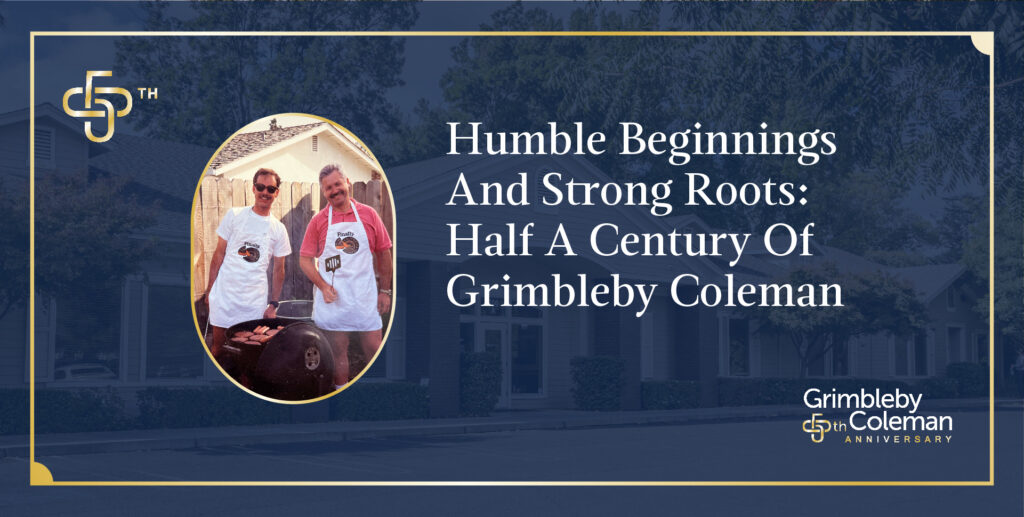

It was 1973. The city of Modesto was growing but still small (only 60K people!). After a long period of post-war prosperity, America was experiencing…

Grimbleby Coleman’s Audit & Assurance (A&A) Team is expanding in ways that weren’t possible even five years ago. Thanks to our brilliant team, leading-edge technology,…

Our team at Grimbleby Coleman is always on alert for scams of all kinds, as they get more “creative” all the time. A new threat…

Members of the GC Estates & Trusts team are always happy when we have the opportunity to attend an estate planning meeting with our clients…

Did you receive a CP14 Notice from the IRS? If so, you are not alone, and it is likely not a scam. The IRS recently…

The United States has a retirement problem. Only 55 percent of employees participate in workplace retirement programs, setting themselves up for potential financial insecurity later in life….

As anticipated, Californians who have been impacted by severe winter storms that resulted in declared disasters will have extra time to get back on their…

Our tax team is again delivering news of a new tax deadline extension in the wake of recent disasters. On February 24, 2023, the IRS extended…

Over the past several years, cryptocurrency — also known as virtual currency — has gone from a fringe investing strategy and questionably nefarious trading method…

The past few years have brought many epic changes to our country and our firm — and yet, as I look forward to 2023, I…

While many Californians and area farmers have been relieved to receive substantial rainfall, we are now faced with the aftermath of receiving it in mass….

Retirement savings plans are undergoing significant changes to ensure that more Americans can save for retirement and increase the amount they can save. Our Tax…

As we approach year-end, our Client Accounting Services team is pleased to provide you with important information to assist you in making necessary changes for…

On November 28, 2022, we sent an article on IRS Schedule K-2 and K-3 Estate and Trusts Reporting Instructions and Requirements. However, changes within the latest…

You’ve heard the old axiom, “cash is king.” In an economic slowdown verging on recession, such as we’re facing now, it’s time to update that…

As inflation continues to be well above the target pace of 2Estate and Trusts% set by the Federal Reserve, no doubt you have been wondering…

Eric Mangal, CPA

Technology and automation breakthroughs in recent years have made it easier than ever before to streamline business accounting practices. Our Client Accounting Services (CAS) team…

It’s year-end once again, and we are repeating a common thought: proactive tax planning ahead of time is the key to managing cash flows and…

Since 2003, the U.S. Department of Homeland Security and the National Cyber Security Alliance have been putting their focus on Cybersecurity awareness during the month…

October 17 – 23, 2022, is a favorite time of the year for our Estates and Trust team — it’s National Estate Planning Awareness Week….

Keeping businesses informed of essential tax updates to significant laws and available grants is a priority at GC. On September 29, 2022, Governor Gavin Newsom…

To simplify our quarterly payroll, sales, and mill tax form delivery process, Grimbleby Coleman will be implementing Suralink effective October 1, 2022. Suralink is an…

A new development on the economic relief front was recently announced by the Internal Revenue Service (IRS). On August 24, 2022, the IRS announced IRS Notice…

On August 16, 2022, President Joe Biden signed the much-anticipated Inflation Reduction Act (IRA), essentially a curtailed version of the Build Back Better Act. The…

This past May, GC sent out information on the Passthrough Entity (PTE) Tax Election. We are now bringing you an important update regarding the 2022…

California Governor Gavin Newsom and legislative leaders have reached a 2022–2023 budget agreement that contains tax refunds to combat inflation as well as other major…

Simplifying an Estate Plan for a Smoother Transition GC Niche: Estates and Trusts GC Team Members Involved: Jamee Bollinger, CPA Type of Industry: Food Production…

Dear Clients, To give you ample time and notice to submit important documents, we are sharing this helpful tool to help ensure that your required…

Martin Fox, CPA/ABV, CVA

When I interviewed for a position at Grimbleby Coleman 19 years ago, I knew this wasn’t an ordinary firm. Our then-CEO, Clive Grimbleby, had a…

We are bringing you an update on California’s Assembly Bill 150 (AB 150), enacted in 2021 as a method for deducting state and local taxes…

If you’ve worked with Grimbleby Coleman before, you know our concept is a little different than most CPA firms. We attribute that to our advisory…

The California State Legislature has proposed a bill that would fix the passthrough entity elective tax and provide additional economic relief, if it passes. The…

In the blink of an eye, we’re switching out our calendars and planning for a whole new year! This past year, our firm went through…

The year is coming to an end. Read below for 2022 payroll and 1099 information. Also enclosed is a summary quick reference guide. Deadline for…