Insights

Get Insights and Sound Advice That Combine Technical Expertise With Industry Expertise

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

Access our robust and well-researched content from our library to gain and apply knowledge relevant to your business.

Human Resource (HR) Consulting Services are designed to help small and mid-sized businesses reduce risk, stay compliant, and create healthier workplaces. Compliance with California labor…

As businesses grow, financial operations become more complex and critical to success. Many organizations reach a point where their internal teams can no longer support…

As harvest time draws near, we’re bringing you the latest updates related to federal payments, disaster relief, key tax law changes, and relief opportunities that…

On July 4, 2025, President Trump signed the “One Big Beautiful Bill Act” (OBBBA). The legislation brings notable tax changes for businesses, individuals, and those…

Selling your business is more than just signing on the dotted line—it’s a financial milestone that can either set you up for long-term success or…

In today’s interconnected world, expanding your business across state lines is no longer a luxury; it’s the new frontier of growth. Expanding across states can…

Business owners invest significant resources and time into growth, yet many overlook the importance of regularly assessing their company’s value. Our recently published article, New…

On March 2, 2025, President Donald Trump announced plans for a strategic crypto reserve, a move that further integrates digital assets into the financial system….

We’ve been hard at work keeping up with the myriad of developments relating to Beneficial Ownership Information (BOI) reporting. In the future, all BOI updates…

Despite our tax team’s efforts to wait for the most reliable updates, we have a new and significant update regarding the reporting requirements for Beneficial…

Let’s try this again. We now have a court-mandated green light to move forward with the new deadline for business owners to submit their mandatory…

Starting a new business is exciting but comes with its fair share of challenges, especially when managing finances and accounting. Many business owners unintentionally skip…

Grimbleby Coleman’s Client Accounting Services team has released the 2025 Payroll Summary to help employers manage payroll tax withholdings, deposit schedules, and key year-end deadlines….

Grimbleby Coleman’s Estates & Trusts team is shedding light on a June 2024 Supreme Court decision that may have implications for your business succession plan….

Investing in real estate can be a great way to build wealth, but knowing the associated tax rules allows you to make the most of…

Starting January 1, 2025, key components of the SECURE 2.0 Act—specifically Provisions 101 and 109— will come into effect, potentially impacting your retirement plan. If…

Grimbleby Coleman’s Tax team has an update for business owners about a recent development regarding the Corporate Transparency Act (CTA). On December 3, 2024, a…

Year-end isn’t just about closing the books—it’s about opening doors to new opportunities. Now is the time to take a forward-thinking approach to your business…

Attention business owners – It’s time to begin reviewing regulations and identifying your company’s beneficial owners for filing your Beneficial Ownership Information Reports (BOIR). BOIR…

If you’re a real estate investor, you’ve likely heard of a 1031 exchange, also known as a “like-kind exchange.” This federal tax provision can be…

As the 2024 presidential election approaches, tax policies are taking center stage, with Vice President Kamala Harris and former President Donald Trump presenting two distinct…

Significant changes in estate tax laws are on the horizon, and preparing now can save you substantial sums in the future. With the current estate…

As a business owner or bookkeeper, you need accounting software that can keep up with your dynamic and evolving needs. QuickBooks, a leading name in…

Cash flow is a major concern for most construction firms. When cash is low, it could mean being unable to make payroll or purchase supplies…

At GC, our focus is proactive problem-solving, strategic planning, and efficiency to drive heightened profitability. Too often, businesses encounter issues only after they’ve already unfolded,…

Tax time can be overwhelming, particularly with the various documents you need to gather. It is easy to lose track of what is essential. Whether…

Just in time for the new year — another filing requirement for business owners. Starting January 1, 2024, business owners will be responsible for reporting…

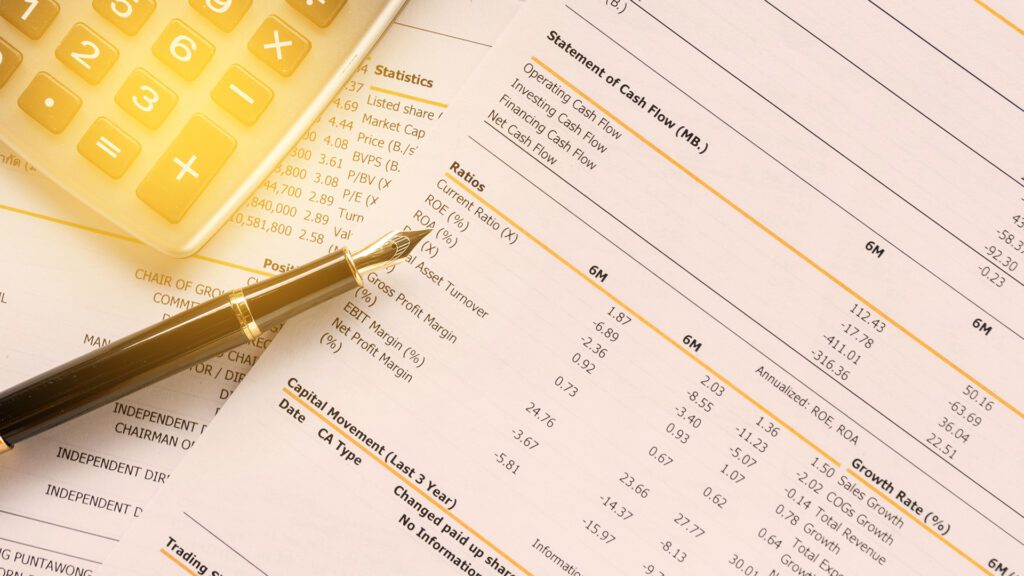

In today’s dynamic economic business landscape, harnessing the power of financial data is essential for informed decision-making. Your financial statements are not just a collection…

Grimbleby Coleman’s 2023 Year-End Tax Planning Guide for Businesses is now available! We all make our assessments at the year’s end, but none more so…

The United States is a generous country, with 69% of taxpayers contributing to charities annually, and being philanthropic offers the added benefit of a charitable…

As the year comes to a close, it’s important to think about your financial goals and make sure they align with your current and future…

The flooding disaster tax relief in California granted most California taxpayers automatic extensions for filing their 2022 tax returns and paying any taxes due; in…

For months, economists and the media have warned us that efforts to curb inflation could lead to a recession. According to the traditional definition of a…

Members of the GC Estates & Trusts team are always happy when we have the opportunity to attend an estate planning meeting with our clients…

Did you receive a CP14 Notice from the IRS? If so, you are not alone, and it is likely not a scam. The IRS recently…

Complexity in construction accounting abounds due to unique requirements, processes, documents, and procedures. Projects often rely on various funding sources to cover expenses such as…

The Inflation Reduction Act of 2022 is studded with opportunities to reap federal tax credit benefits. Two of those credits, the Residential Clean Energy Credit…

Over the past several years, cryptocurrency — also known as virtual currency — has gone from a fringe investing strategy and questionably nefarious trading method…

The past few years have brought many epic changes to our country and our firm — and yet, as I look forward to 2023, I…

While many Californians and area farmers have been relieved to receive substantial rainfall, we are now faced with the aftermath of receiving it in mass….

Retirement savings plans are undergoing significant changes to ensure that more Americans can save for retirement and increase the amount they can save. Our Tax…

As we approach year-end, our Client Accounting Services team is pleased to provide you with important information to assist you in making necessary changes for…

Once again, it is time to provide information for the timely filing of 1099 forms. Our revised 1099 information collection spreadsheet can be downloaded here….

On November 28, 2022, we sent an article on IRS Schedule K-2 and K-3 Estate and Trusts Reporting Instructions and Requirements. However, changes within the latest…

You’ve heard the old axiom, “cash is king.” In an economic slowdown verging on recession, such as we’re facing now, it’s time to update that…

It’s year-end once again, and we are repeating a common thought: proactive tax planning ahead of time is the key to managing cash flows and…

Since 2003, the U.S. Department of Homeland Security and the National Cyber Security Alliance have been putting their focus on Cybersecurity awareness during the month…

October 17 – 23, 2022, is a favorite time of the year for our Estates and Trust team — it’s National Estate Planning Awareness Week….

Keeping businesses informed of essential tax updates to significant laws and available grants is a priority at GC. On September 29, 2022, Governor Gavin Newsom…

Completing a Transition, One Step at a Time GC Niche: Estates and Trusts GC Team Members Involved: Stephen Wray, CPA, and Ian Grimbleby, CPA Type…

It has already been a long year for growers. Water woes, supply chain slowdowns, and rising inflation have combined to create an epic storm of…

We are bringing you an update on California’s Assembly Bill 150 (AB 150), enacted in 2021 as a method for deducting state and local taxes…

In the construction world, very little gets done without bonding agencies. Such agencies protect contractors and their customers against disruptions or financial loss. Construction projects…

If you’ve worked with Grimbleby Coleman before, you know our concept is a little different than most CPA firms. We attribute that to our advisory…

Martin Fox, CPA/ABV, CVA

It seems like you can’t go a day without hearing about supply-chain disruptions, inflation, or labor shortages. These three issues are having profound impacts on…

In the blink of an eye, we’re switching out our calendars and planning for a whole new year! This past year, our firm went through…

Grimbleby Coleman Accountants & Advisors

November 15, 2021 Few businesses are continuously profitable year after year. In fact, according to the publication Small Business Trends, only 40 percent of small…

Out of the plethora of retirement planning options available to U.S. workers — 401(k)s, 403(b)s, traditional IRAs — the Roth IRA stands out as the…

At Grimbleby Coleman CPAs, we work with clients to achieve superior financial and operational results, but one of the major roadblocks to success we’ve seen…

If you are one of the millions of Americans who will receive the Advanced Child Tax Credit in a few weeks, you should also be…

As a business owner, you likely know how crucial it is to maintain a handle on your company’s finances. Like many multi-tasking owners, however, you…

Governor Gavin Newsom has signed Assembly Bill 80, to amend the law. This will bring conformity to the federal treatment of PPP loan forgiveness and…

What Are Fixed Assets? When accountants use the term “fixed asset,” they are referring to a physical asset that is acquired by a company and…

Martin Fox, CPA/ABV, CVA

WOW! There’s a lot to talk about in this week’s e-blast. We’ll start with the highlights, but for those of you who want the details,…

The decision to sell or purchase a business is a complex one that requires careful assessment of financial, operational, and other key variables. The equation…

Martin Fox, CPA/ABV, CVA

What Changed? On March 3, the SBA announced a major change to PPP loans for self-employed individuals who file a Schedule C. They can now…

Title: Ag Case Study: An Embedded Approach to a CFO Vacancy GC Niche: Ag GC Team Member(s) Involved: Jeff Bowman, Clive Grimbleby Type Of Industry:…

Martin Fox, CPA/ABV, CVA

If your business cash flow needs a boost to get you through the COVID-19 crisis, take another look at the Paycheck Protection Plan (PPP) loans….

The Employee Retention Tax Credit (ERC) is designed to help businesses affected by the Coronavirus Pandemic and provides a refundable payroll tax credit to companies…

Happy New Year, friends! I hope you enjoyed the holidays and that 2020 closed out on a high note. As you likely know (and hopefully…

Martin Fox, CPA/ABV, CVA

December 21, 2020 Santa came to town early today for many small businesses. Congress finally agreed to a COVID-relief bill that will put some much-needed…

December 30, 2020 Much attention is currently focused on the federal stimulus bill that was enacted on December 27th and its provisions to activate another round…

Martin Fox, CPA/ABV, CVA

November 30, 2020 We have recently become aware of clients receiving solicitation emails about their PPP loans. Some business owners presumed these were official notices…

Martin Fox, CPA/ABV, CVA

The IRS issued a highly anticipated (and much-needed) ruling today regarding the tax treatment of PPP loan forgiveness and the related expenses covered by those…

November 17, 2020 Ag has been a key part of our practice from the very start — 47 years and “ac-counting”. We know ag because…

Grimbleby Coleman Advisors & Accountants

November 17, 2020 Construction is one of the most labor-intensive industries out there — and we’re not just talking about the hard work of building….

November 3, 2020 Much has changed throughout this year. As 2020 comes to a close, you can be sure of one constant: future tax filings…

October 21, 2020 On October 1, the Department of Health and Human Services (HHS) provided guidance for health care providers who have already received relief…

October 20, 2020 This week, (October 19 – October 25, 2020) is National Estate Planning Awareness Week. In the accounting world, it’s a week dedicated…

Martin Fox, CPA/ABV, CVA

October 9, 2020 Yesterday, the SBA released a new simple one-page loan forgiveness application (Form 3508S) for PPP borrowers with loans of $50,000 or less….

September 11, 2020 On September 8, 2020, an executive order was signed by President Trump to defer the withholding, deposit, and payment of certain payroll…

Martin Fox, CPA/ABV, CVA

September 10, 2020 We live in a world of scoreboard watchers. Go to any sporting event, and you’ll see massive scoreboards displaying all sorts of…

Martin Fox, CPA/ABV, CVA

September 10, 2020 We live in a world of scoreboard watchers. Go to any sporting event, and you’ll see massive scoreboards displaying all sorts of…

August 10, 2020 A short time ago, many of us would not have thought that our lives would essentially come to a screeching halt due…

Martin Fox, CPA/ABV, CVA

July 27, 2020 If you’re like most PPP borrowers, you’re anxious to apply for loan forgiveness with your bank. Here’s what we’ve heard from some…

Martin Fox, CPA/ABV, CVA

June 18, 2020 On Tuesday, June 16, the SBA released two new versions of the PPP Loan Forgiveness Applications, including an EZ version for certain…

Martin Fox, CPA/ABV, CVA

July 6, 2020 While all good things must come to an end, the Paycheck Protection Program (PPP) was just given a new life. On July…

Many of our clients are small and medium-sized California businesses, which means they are now required to provide their employees with access to retirement savings…

Martin Fox, CPA/ABV, CVA

May 26, 2020 Now that many of the Paycheck Protection Program (PPP) loans are about half-way through their eight-week loan forgiveness period, many borrowers have…

May 21, 2020 The US Department of Agriculture (USDA) recently announced more information on new direct payments to eligible farmers and ranchers through the Coronavirus…

Martin Fox, CPA/ABV, CVA

May 13, 2020 Over the past week or so, you may have heard various reports that the SBA was going to be reviewing PPP loans…

Martin Fox, CPA/ABV, CVA

We’re seeing an emerging trend in which many business owners are moving out of their ag businesses and passing control to their children. This transition…

Martin Fox, CPA/ABV, CVA

April 10, 2020 In one of our recent emails, we outlined various ways you can access cash for your business during these turbulent times. Starting…

April 6, 2020 The United States Department of Labor (DOL) has recently released the FFCRA which requires certain employers to provide paid sick leave and…

Martin Fox, CPA/ABV, CVA

April 1, 2020 We are in the throes of a crisis like none we have ever seen before. As people are hunkered down in their…

Martin Fox, CPA/ABV, CVA

Do you know what your break-even point is? Your break-even point represents the number of units you need to sell to exactly cover your costs…

March 4, 2020 How to Leverage Your Real Estate Portfolio Without Forgetting Taxes If you’re a typical real estate investor (asset rich, cash poor) trying…

In the construction industry, job costing can mean the difference between making money and losing money. The stakes are high when rising labor prices, cost…